As previously highlighted, my investment strategy predominantly centers around the utilization of low-cost index funds. While I do maintain a limited position in individual stocks, these constitute only a marginal portion of my overall investment portfolio. The rationale behind my preference for index funds is grounded in their distinct advantages, which I find particularly appealing. Index funds offer the unique benefit of immediate diversification, even with a modest initial investment. This diversification shields me from the perils associated with putting all my eggs in one basket. Moreover, the passive management approach adopted by index funds provides a layer of protection against the unpredictability of star performers, like money managers who may excel in one year but falter in subsequent years. This long-term consistency aligns well with my investment philosophy. Given the inherent risk that comes hand in hand with individual stocks, I exercise caution when selecting specific companies to include in my portfolio. My primary objective is to craft a meticulously curated collection of stocks, centered around a particular thematic focus. This approach allows me to minimize risk and align my investments with my long-term financial objectives. The bedrock of my investment strategy lies in balancing the potential for returns with prudent risk management. By concentrating on index funds and carefully selected individual stocks, I aim to achieve a diversified and well-structured investment portfolio, ideally positioned to weather the fluctuations of the financial markets while progressing toward my financial goals.

When it comes to low-cost index investing, the name Vanguard instantly springs to mind. Vanguard's pioneering spirit in the investment industry is well-documented. In fact, they were the trailblazers who introduced the very first index fund, the S&P 500, in 1976. Now, I'd like to introduce the dividend community to Vanguard Dividend Appreciation Index Fund (VDAIF), a gem that holds a significant position in my investment portfolio, constituting approximately 10% of my total investments. VDAIF is a vehicle that grants investors access to a diverse range of quality dividend-paying stocks, coupled with the convenience of a hands-off approach to investing. This fund specializes in domestic stocks that have a proven track record of consistently increasing dividends over the years. As an index fund, VDAIF endeavors to replicate the performance of the NASDAQ US Dividend Achievers Select Index, which is a selection of stocks from companies boasting at least a decade of annual dividend increases. The allure of VDAIF lies in its ability to offer investors a simple yet effective strategy for capitalizing on the steady income and growth potential that dividend-paying stocks can provide. Its commitment to quality and longevity in dividend increases aligns well with the objectives of income-oriented investors. With VDAIF as part of my investment portfolio, I'm able to enjoy the benefits of a well-diversified selection of dividend achievers while maintaining a hands-off, hassle-free approach to my investment management. Regenerate

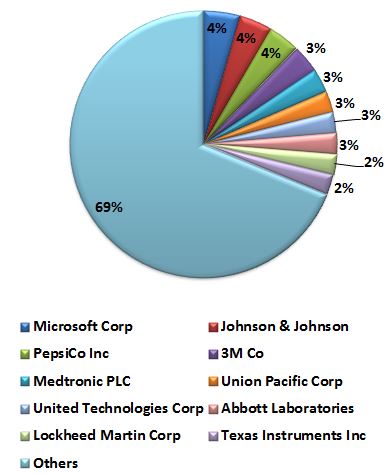

VDAIF, the Vanguard Dividend Appreciation Index Fund, is an investment vehicle that prudently comprises a diversified portfolio of 181 stocks. What sets these stocks apart is their impressive track record of consistently increasing their yearly dividends for a minimum of 10 consecutive years. Such a remarkable feat is a testament to the financial strength and resilience of these companies, as they consistently demonstrate the ability to maintain a strong balance sheet while rewarding their shareholders. Within this meticulously crafted portfolio, the top 10 stocks take a prominent position, collectively constituting approximately 31% of the overall portfolio's value. Notably, among these top holdings, Microsoft (MSFT) stands as the largest single holding, commanding a weight of 4.41%. This strategic allocation within VDAIF underscores the fund's commitment to a diversified yet weighted approach, allowing investors to benefit from the performance of a select group of companies renowned for their consistent dividend growth. Microsoft's significant presence within the portfolio serves as a prime example of the caliber of companies that VDAIF includes, underpinning the fund's focus on quality and financial stability.

VDAIF, the Vanguard Dividend Appreciation Index Fund, boasts a well-diversified portfolio that spans across a variety of sectors. This diversification strategy is instrumental in minimizing risk and enhancing the resilience of the fund. However, it's important to note that VDAIF does exhibit a particular concentration within the industrial sector, representing a substantial 33% of its overall portfolio. This allocation is noteworthy because a significant portion of dividend growers and achievers can be found within the industrial sector. It's worth highlighting that VDAIF has intentionally excluded any exposure to the energy sector. This strategic choice aligns with the fund's objective to offer investors a well-rounded, income-focused investment approach. By omitting the energy sector, VDAIF can offer a unique value proposition that emphasizes the quality and consistency of dividend growth from other sectors while avoiding the potential volatility and cyclical nature associated with the energy industry. This sector allocation within VDAIF underscores the fund's commitment to delivering reliable, long-term income and capital appreciation while maintaining a prudent level of diversification and risk management.

VDAIF, the Vanguard Dividend Appreciation Index Fund, is primarily comprised of large-cap stocks, signifying the fund's inclination towards established and well-established companies with significant market capitalization. Despite its focus on dividend-yielding assets, VDAIF does not significantly emphasize value stocks, setting it apart from traditional dividend funds. It's worth classifying this fund as a "blend" fund, one that embodies both growth and value characteristics within its portfolio. In my perspective, VDAIF aligns more with the essence of a quality stock fund, given its propensity to emphasize companies with solid financial fundamentals, dividend growth potential, and a track record of consistency. However, it's essential to acknowledge that VDAIF does possess some exposure to mid and small-capitalization stocks. This diversification across different market capitalization segments adds an additional layer of versatility to the fund's strategy. The fund's ability to strike a balance between growth and value, while incorporating a variety of market capitalization ranges, underlines its potential to offer investors a well-rounded approach to income and capital growth. This comprehensive approach caters to the needs of those seeking quality stocks while maintaining the benefits of diversification across different segments of the market.

Before I mention dividends, I wanted to talk about expenses. VDAIF is available in 3 categories. As an

Before diving into the discussion on dividends, it's important to consider the expense structure of VDAIF. Vanguard Dividend Appreciation Index Fund offers investors three distinct categories to choose from, each catering to different preferences and financial strategies. These categories are:

- Vanguard Dividend Appreciation Index Fund Investor Shares (VDAIX): This is a versatile option for investors looking to access the benefits of VDAIF while maintaining a more accessible cost structure.

- Vanguard Dividend Appreciation Index Fund Admiral Shares (VDADX): For those seeking a more cost-effective approach, Admiral Shares offer a lower expense ratio, making them a prudent choice for investors with larger portfolios.

- Vanguard Dividend Appreciation ETF (VIG): The ETF option provides an additional level of flexibility for investors who value the convenience of exchange-traded funds while still benefiting from VDAIF's investment strategy.

VIG is designed for investors who appreciate the ease and flexibility of trading it just like a stock. This ETF can be bought and sold through any brokerage, although standard commissions may apply. For those with a Vanguard brokerage account, there's an added perk - commission-free trading of VIG. Its standout feature is its impressively low expense ratio, set at a mere 0.08%. One limitation to consider is that it doesn't offer fractional shares for purchase, but it does allow you to reinvest dividends in fractional shares. The entry threshold to own a share of VIG is quite accessible, with just $97.06 required for a single share. However, due to the lack of fractional shares, setting up an auto-investment plan may not be feasible.

VDADX serves as the mutual fund counterpart to VIG ETF, sharing the same attractive expense ratio of 0.08%. This option is tailored for investors with a slightly larger portfolio, as it requires a minimum investment of $10,000. The key advantage here is the ability to purchase fractional units, which can be particularly beneficial for dollar-cost averaging strategies. Investors can also establish auto-investment plans on a daily, weekly, or monthly basis, further enhancing convenience.

VDAIF offers a more accessible entry point with a minimum investment requirement of $3,000. However, it comes with a slightly higher expense ratio of 0.17%. This option is well-suited for those who prefer to start with a smaller investment but are willing to accept a marginally higher cost structure.

The choice of discussing expense ratios before delving into dividend details is intentional, as the expense ratio plays a direct role in impacting the actual dividend yield. Therefore, it's crucial to understand that the expense ratio can affect the final yield received by investors. This means there can be variations in yields among the three varieties of Vanguard dividend investments.

VIG boasts a competitive dividend yield of 1.90%, making it an attractive option for income-oriented investors. To put this into perspective, it paid a dividend of $0.43 on September 25, 2017. It's important to note that all the mentioned varieties, including VIG, disburse their dividends on a quarterly basis.

For Canadian investors looking to explore the opportunities presented by this exceptional fund, there are two distinct ETFs to consider. These ETFs cater to different preferences, offering options with and without currency hedging. Unfortunately, the mutual fund variant is not available for Canadian investors.

- U.S. Dividend Appreciation Index ETF (CAD-hedged) (VGH): This option provides Canadian investors with the advantages of a currency-hedged approach, minimizing the impact of fluctuating exchange rates. It's a prudent choice for those seeking stability in currency exposure while benefiting from the potential of the underlying fund.

- U.S. Dividend Appreciation Index ETF (VGG): On the other hand, VGG is designed for investors who prefer an unhedged approach, thus being more exposed to currency fluctuations. This option may appeal to those comfortable with the potential advantages and risks associated with the exchange rate.

It's essential to consider the tax implications associated with investments in Vanguard Dividend Appreciation Index Fund and its variants. Dividends from these funds are categorized as Qualified dividends, which come with the advantage of being taxed at long-term capital gains rates. These rates are typically lower than ordinary income tax rates, making them an attractive choice for investors seeking tax efficiency. However, it's advisable to consider housing such investments in a tax-advantaged account to maximize tax benefits.

One aspect that's easy to overlook is the trade-off of diversification. While owning a single share of VIG or its equivalents provides immediate exposure to a diversified portfolio of over 200 stocks, it does mean relinquishing the ability to handpick individual stocks. Nevertheless, the overarching understanding is that this basket of carefully selected stocks, managed by experts, is structured to perform well collectively. This trade-off highlights the significance of weighing the benefits of diversification against the desire for specific stock selection and the implications it might have on an investor's overall strategy.

Hi Geek, I think your strategy is very sound. My favorite Vanguard ETF is the Vanguard High Yield Dividend ETF (VYM). VDAIF is another great one as you discuss. Tom

ReplyDeleteThanks! I hold VYM too.

DeleteAwesome Geek. Before I created my portfolio, I was struggling with the decision about the makeup of my portfolio. Should I go with individual stocks or index funds. For the longest while, I gravitated towards index funds and ETFs, but finally settled on individual stocks. And I'm glad I did. It's probably a ridiculous reason, but I chose individual stocks because I thought it would be more fun to keep track of, which of course meant that I would keep up with the portfolio.

ReplyDeleteThat being said, I definitely see the value of index funds. In fact, my retirement account is made up of only one fund, which is the VTSMX, which is the Vanguard Total Market Stock Index Fund. I was also thinking about VYM and VIG, and I may still add them to my portfolio, but it seemed redundant. But, for the reasons you mentioned, in terms of diversification, low fees, etc, I chose the safer option for my retirement account.

Thanks for giving me another fund to consider.

Hello DP,

DeleteThere is something for everyone with these ETFs. Even if you want to invest on your own, VIG still gives us a list of stocks with 10+ years of dividend increases. We could work of that list to find value. There is definitely overlap between VTI VYM and VIG.

Thanks for sharing this!

ReplyDeleteThey do look like an attractive investment

Shares to Buy

This comment has been removed by the author.

ReplyDeleteThese websites are really needed, you can learn a lot. best natural treatment for erectile dysfunction

ReplyDelete