I stumbled upon some intriguing (albeit delayed) news regarding Vanguard Canada's recent launch of three new ETFs. Being an avid Vanguard enthusiast, I couldn't resist investigating further. These ETFs bear a striking resemblance to the target date funds available in the United States. Nevertheless, what sets them apart is their unchanging asset allocation over time. Each ETF is designed to adhere to a specific asset allocation pattern, encompassing Canadian bonds, US stocks, Canadian stocks, developed market stocks/bonds, and emerging market stocks/bonds.

It mimics different allocations using 7 underlying ETFs.

- Vanguard Canadian Aggregate Bond Index ETF

- Vanguard US Total Market Index ETF

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- Vanguard FTSE Canada All Cap Index ETF

- Vanguard US Aggregate Bond Index ETF CAD-hedged

- Vanguard FTSE Developed All Cap EX North America Index ETF

- Vanguard FTSE Emerging Markets All Cap Index ETF

Vanguard Growth ETF Portfolio (VGRO)

The Vanguard Growth ETF Portfolio, denoted as VGRO, is meticulously designed to cater to the pursuit of long-term capital growth, making it the most assertive and aggressive choice within the Vanguard portfolio offerings. A significant 80% of the portfolio is strategically allocated to equities, which encompass a diversified array of stocks. Meanwhile, the remaining 20% is prudently invested in bonds, forging a well-balanced approach that combines the potential for high returns with a degree of risk mitigation. VGRO exemplifies a prudent investment strategy for those with a robust appetite for capital growth while understanding the necessity of diversification and risk management.

Vanguard Conservative ETF Portfolio (VCNS)

The Vanguard Conservative ETF Portfolio, known as VCNS, presents an intriguing investment opportunity deserving a closer look. It is designed to offer a unique blend of financial objectives, focusing on delivering a combination of regular income generation and facilitating steady, moderate long-term capital growth. One distinctive aspect of VCNS is its asset allocation strategy, with 40% of the portfolio thoughtfully allocated to equities, encompassing a diversified range of stocks. This equity component is geared towards harnessing the potential for growth in the long run. Complementing this are the remaining 60% of assets invested in bonds, serving as a stabilizing force to mitigate risk and ensure financial resilience. VCNS embodies a prudent investment approach that appeals to individuals seeking to strike a balanced equilibrium between consistent income and gradual capital appreciation. It is an investment avenue that aligns with the goals of those who value both financial security and the potential for controlled growth in their portfolios.

Vanguard Balanced ETF Portfolio (VBAL)

The Vanguard Balanced ETF Portfolio, bearing the acronym VBAL, is an intriguing investment vehicle that warrants in-depth exploration. This portfolio is strategically constructed to offer a unique blend of financial objectives, with a focus on achieving long-term capital growth while maintaining a moderate level of income. One notable characteristic of VBAL is its meticulously crafted asset allocation strategy. A significant 60% of the portfolio is dedicated to equities, comprising a diversified selection of stocks. This equity allocation is designed to harness the potential for substantial long-term capital growth. Complementing this equity component is the allocation of 40% to bonds, which acts as a stabilizing force, contributing to the overall balance of the portfolio. VBAL embodies a judicious investment approach suitable for investors who seek to strike a harmonious equilibrium between long-term capital appreciation and a steady stream of income. It caters to those who value both the potential for controlled growth and the stability that bonds provide in their investment portfolios. VBAL stands as a compelling choice for individuals aiming to secure their financial future while pursuing modest income alongside capital growth.

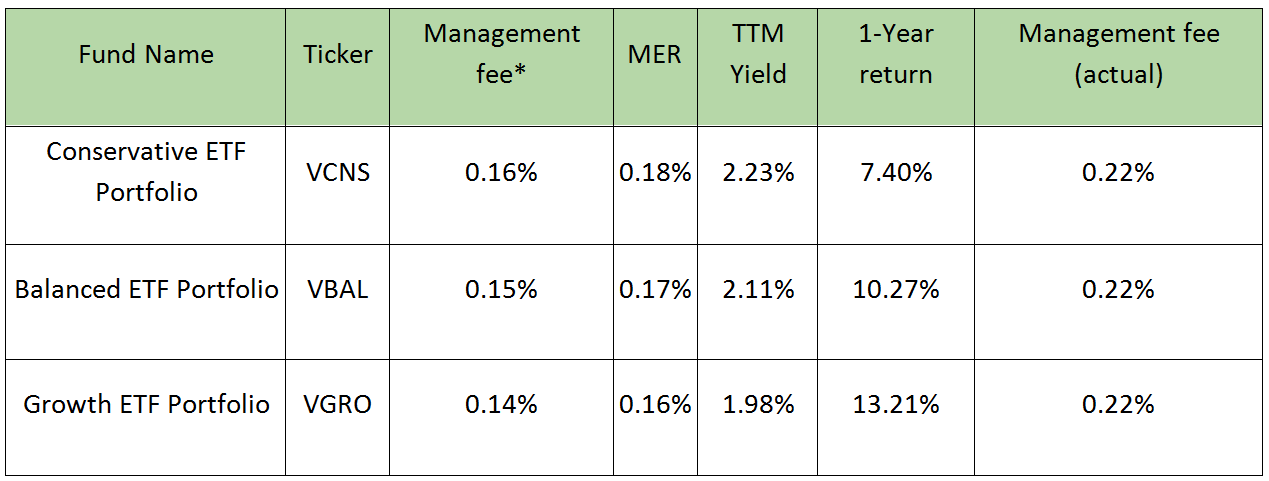

Within the context of these ETFs, it's worth considering their management fees, which stand at a competitive 0.22%. When we draw a comparison with their counterparts in the United States, namely the target date funds, we find that these ETFs offer an appealing value proposition. The typical expense ratio for target date funds in the US hovers around 0.16%. The question that naturally arises is whether these ETFs can be deemed "cheap" in the realm of investment. To evaluate this, it's essential to understand that these ETFs operate as funds of funds. This unique structure simplifies the process of calculating the expense ratio of the holding fund by examining the constituents within it. This information was carefully compiled as of February 26, 2018, and it underscores the cost-effectiveness of these ETFs, making them a compelling choice for investors who prioritize efficiency in their investment strategy. The ability to access a diversified portfolio of assets with such competitive management fees solidifies the appeal of these ETFs in the financial landscape.

When evaluating the cost-efficiency of all-in-one ETF portfolios like VGRO, it's evident that building an equivalent portfolio by purchasing individual ETFs can substantially reduce management fees. In the case of VGRO, the cost difference amounts to a significant 57.14% increase. This is a notable price to pay for the convenience that all-in-one ETFs provide.

While 0.08% may seem like a small fee on its own, it's crucial to remember that fees have the potential to compound over time as your assets grow. The challenge with individual ETFs lies in their inability to offer fractional shares. This makes it nearly impossible to construct a diversified portfolio, particularly if you have limited capital to invest. In such cases, opting for an asset allocation ETF, like VGRO, may be the most prudent strategy.

One significant drawback of all-in-one ETF portfolios is the issue of balancing. As investors age, their asset allocation should ideally shift from growth-focused to balanced and eventually to conservative. However, each of these transitions can trigger taxable events. Even if the new allocation maintains the same amount of Canadian stocks, you are forced to sell the entire position and repurchase it. This could lead to unnecessary tax liabilities.

Auto-balancing poses another problem. To maintain asset allocations, periodic rebalancing is necessary, which can result in taxable distributions. In some instances, you might find yourself paying taxes on capital gains, even if your overall portfolio is at a loss.

Moreover, the tax efficiency of underlying assets varies. Typically, index funds with low capital gains distributions and dividends are better suited for taxable accounts, while bonds are more appropriate for tax-advantaged spaces. A fund of funds like VGRO might not be the most tax-efficient way to allocate your investments across these spaces, putting you at a disadvantage.

While Vanguard believes in international bonds, not all investors share this perspective, favoring the risk associated with international equities over bonds. All-in-one ETFs might not align with these preferences, as they often include international bonds.

Lastly, it's worth considering John Bogle's advice not to own too many funds. Building a tax-efficient portfolio with a smaller number of funds is certainly achievable. However, in the Canadian market, Vanguard's selection of funds is more limited compared to the US market. For instance, you could achieve broad international exposure with just one ETF, such as FTSE Global All Cap ex Canada Index ETF (VXC), and if necessary, add Vanguard US Total Market Index ETF for additional US exposure.

In summary, while it may be worthwhile to construct a diversified portfolio from scratch, the lack of fractional shares makes this a challenging endeavor. Vanguard All-in-One ETFs offer the convenience of a well-diversified portfolio with exposure to multiple equity and bond ETFs. Nevertheless, this convenience comes at a premium. It might be most efficient to place these ETFs in tax-advantaged spaces to mitigate potential tax complications.

Source: Vanguard Canada

Hey DG, I'm more of a DIY investor, but products like this do have benefits for the many who are not. Tom

ReplyDeleteAgree Tom. Its definitely useful for people who don't have the time. I personally like to create my own asset allocation.

DeleteHey DG,

ReplyDeleteI am DIY investor and like the lower cost ETF and stocks, but for those who do not like or have investment knowledge these products have a place in a portfolio. With an MER 0.23 you have lots of diversification. I agree with a little bit of knowledge it would probably be worth trying to build a diversified portfolio yourself.

Hey Steve,

DeleteI am kinda appalled by the lack of ETFs in Vanguard Canada. Not much in terms of growth, value etc. For someone starting out with small amount money these funds provide immediate diversification. 0.23 MER is definitely on the higher side.