It's September, summer is coming to an end. Time for my quarterly dividend update. For the past 3 months I have been happily following the dividend updates from my fellow bloggers. Seems like it took forever for vanguard to payout dividends.Typically Q2 and Q4 are best for vanguard mutual funds. Q1 and Q3 are reasonable.

2017 Q3 dividends:

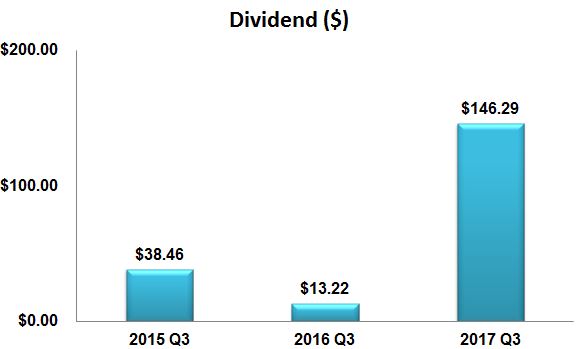

For second quarter in a row, my dividends hit the three figure mark. I am hoping to sustain this going forward. 2017 Q4 should be easy. 2018 Q1 would be the real challenge. I am worked up to face this challenge. I have added a new goal, to reach 200$ in dividend in a single quarter. I also reached my goal of 500$ in forward dividends ($542.76).The new goal is 750$ in forward dividends. My goals have been updated to reflect these new changes.| Quarter | Dividend | % Change |

|---|---|---|

| 2015 Q3 | $38.46 | 0.0% |

| 2016 Q3 | $13.22 | -65.63% |

| 2017 Q3 | $146.29 | 1,006.58% |

Yes! 1,000% increase in dividends. In 2016 Q3 I had to liquidate a portion of my portfolio to meet some expenses. Hence the dramatic drop (-65.63%) as compared to 2015 Q3. I am glad to bounce back from that debacle. Sustained saving and investing is the way to success. I have learnt this the hard way at 35. I hope Gen Y/Z does much better.

Dividend Increases

Expected: Estimation based on the dividends given out in 2016 Q3Actual: Actual dividend I received in 2017 Q3

I call this as organic increase in dividends. There was an organic increase in dividends across all my mutual funds and ETFs. Some where very small the others were more sizable. What matters is the direction and fortunately all of them have been going up. Highest dividend increase is from my REIT mutual fund (145.95%). REITs are a very small part of my portfolio, hence its effect is minimal. The real bump came from the dividend increase in my S&P 500 ETF (33.37%).

Portfolio:

As mentioned before all my investments are in vanguard mutual funds and ETFs. S&P 500 ETF (VOO) is about 44.85% of my portfolio. Dividend aristocrats form about 3.95% of my portfolio, High yield stocks come in at 4.00%, REITs at 4.37%, International stocks at 31.64% and finally value stocks at 11.20%. However, I don't plan to chase yield. My portfolios average expense ratio is 0.12%.I have been rapidly growing my value stocks position. The idea is to increase exposure to financial stocks, with the rate hike looming I believe the financial sector will do well. It also helps to diversify my portfolio as I am heavily into technology sector (Thanks to VOO). During Q3 my portfolio increase by 32.52%.

Geek, it looks like you had a solid quarter. Congrats on hitting 3-digits 2 quarters in a row and congrats again for surpassing the $500 mark in forward dividends. Great report Geek.

ReplyDeleteThanks DP. I hope to sustain this going forward.

DeleteYou are achieving your goals! congrats!!! I started the saving and investment very late in my life in late 40s. It is always better to learn to invest before you you hit age 65.

ReplyDeleteThanks PS. It's never too late. I am 35 (36 in a month). I started investing at 33. Hopefully we will be able to retire comfortably :-)

DeleteYou are killing it this quarter/ year! Awesome work! Over 1000% increase is huge and 30% increase on your portfolio in one quarter is great. Would be nice to keep that pace up. Congrats on your milestones! One quarter left to go still. I can't wait to see more records being broken.

ReplyDeleteThanks DD. This year has been awesome. I will be watching your September update ... good luck

Delete