This blog post draws inspiration from a thought-provoking article by Rob@MustardSeedMoney, in which he pinpoints Monday as the optimal day for stock market investments. Given my substantial engagement in passive investment and dollar-cost averaging, Rob's assertion piqued my interest. I embarked on a mathematical exploration to assess the validity of designating Monday as the most advantageous day for implementing a weekly dollar-cost averaging strategy. Are you prepared to delve into the findings? By scrutinizing the data and crunching the numbers, I aim to provide a comprehensive assessment of the feasibility and effectiveness of such a strategy. So, let's embark on this journey together and uncover whether Monday truly shines as the premier choice for enhancing the benefits of dollar-cost investing on a weekly basis.

The data utilized for this comprehensive analysis is sourced from Google Finance, focusing on the pricing trends of VFINX (Vanguard S&P 500 Index Fund) within the timeframe spanning from January 3, 2000, to April 27, 2018. Within this duration, weekdays exhibit a relatively equitable distribution, encompassing Monday through Friday. Notably, we have excluded Saturdays and Sundays from the analysis since executing financial orders is not feasible during the weekend.

During the specified timeframe, encompassing a total of 4,506 days, the distribution of weekdays is as follows. It's worth noting that the slight variations in the number of days are attributable to trading holidays occurring on weekdays, thus affecting the overall distribution:

Suppose we have a weekly investment allocation of $1,000, and our objective is to explore various investment scenarios. Specifically, we aim to determine whether the choice of the investment day of the week yields any discernible impact on the ultimate performance of our investment portfolio. To accomplish this, we conduct a series of experiments, investing $1,000 on different days of the week.

The table provided below presents a comprehensive breakdown of the outcomes associated with investing on each specific day of the week. Our investigation encompasses diverse scenarios, such as investing $1,000 every Monday, Tuesday, and so forth.

The investment distribution among the different weekdays exhibits non-uniformity, resulting in varying invested sums. Interestingly, Monday emerges as the most favorable day for investments, yielding an impressive 99.13% return, reflecting a 0.61% increase. However, when considering the absolute investment amount, Wednesday outperforms, with a substantial total of $912,168.77 invested. This discrepancy can be attributed to the availability of more substantial funds for investment on Wednesdays.

The preference for Wednesday as an optimal investment day aligns with the observation that holidays tend to cluster at the beginning or end of the week. Consequently, Wednesday represents an opportune day for maximizing investment amounts, given the availability of capital resources. While Monday demonstrates commendable returns, Wednesday offers the advantage of greater capital deployment, underscoring a pragmatic and strategic approach to investment planning. In summary, the choice of the best investment day is contingent on factors such as available funds and the potential for maximizing investment capital, while also considering the observed day-of-the-week trends in investment performance.

How can we standardize this dataset for a more equitable analysis? To achieve a balanced distribution of days, I've introduced a slight alteration to my algorithm. In this revised approach, whenever a holiday is encountered, I presume that the fund's value remains consistent with its previous closing price, signifying that there was no price change on that particular day. This adjustment ensures an even distribution of the 4,780 days across each day of the week, balancing the dataset.

With this modification in place, I proceed to recalculate the investment scenarios. It's important to note that the total investment amount remains constant across all investment strategies, ensuring a fair comparison. This revised approach enables us to explore the investment outcomes on a level playing field, free from the distortions introduced by uneven day-of-the-week distributions. By employing this standardized methodology, we aim to gain a more accurate and unbiased understanding of the investment performance associated with different days of the week.

It's abundantly evident that there exists no discernible advantage linked to choosing a specific day of the week for investment purposes. The incremental gains, at their utmost, remain rather marginal. Notably, in this reevaluated dataset, Monday emerges as the day with the highest return, albeit with a slight uptick of 0.13%, culminating in a total return of 99.82%.

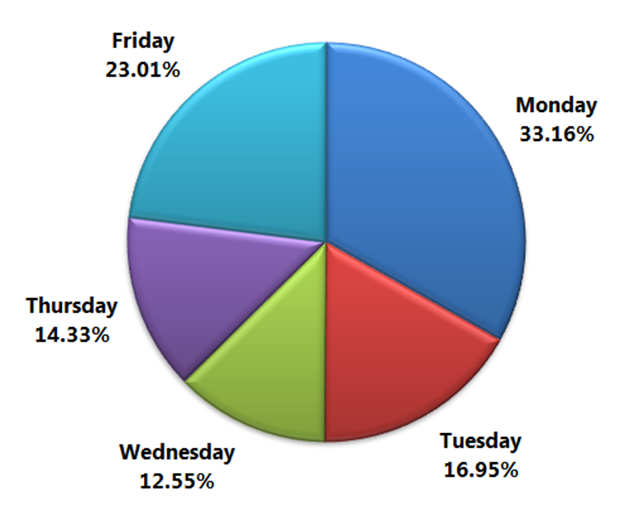

The question that naturally arises is: why does Monday appear to offer slightly improved returns? Upon closer examination of our data, which encompasses a substantial 4,780 days or 956 weeks, a noteworthy observation emerges. Out of these 956 weeks, the lowest price within a given week occurred on a Monday on 317 occasions, accounting for approximately 33.16% of all the weeks analyzed.

This phenomenon suggests that, historically, Mondays may have occasionally coincided with lower price points within the week, potentially contributing to the slightly improved returns observed for investments made on this day. However, it's imperative to emphasize that these variances are relatively minor and may not warrant a substantial shift in one's investment strategy. Prudent, diversified, and long-term investment practices are likely to remain the primary determinants of consistent and satisfactory returns, regardless of the specific day of the week on which investments are executed.

Monday may exhibit the highest frequency of being the day with the lowest weekly prices, but it's essential to acknowledge that it doesn't consistently hold that distinction. In fact, on approximately 66.84% of occasions, the lowest value throughout the week is found on a day other than Monday. This realization prompts us to question the optimality of our initial greedy investment strategy.

To enhance our investment approach, one strategy is to replace the simplistic, greedy model with a more probabilistic one. Instead of rigidly adhering to investing every Monday, we can adopt a probability-based model. Within this framework, we allocate a probability to each day of the week for investment. For instance, we may assign a 23.01% likelihood of selecting Friday, a 16.95% chance of choosing Tuesday, and so on. Notably, we assign a higher probability to Monday, reflecting its historical tendency to host the lowest prices in a given week, which stands at 33.16%.

By embracing this probabilistic investment model, we aim to strike a balance between the observed patterns in weekly lows and the inherent unpredictability of financial markets. This approach seeks to enhance the odds of making strategic investments while recognizing the variability and complexity inherent in investment decisions.

The outcomes presented here stem from a probability-based simulation, a process highly influenced by the generation of random numbers. Consequently, it's crucial to acknowledge that the results are subject to variability, and they may diverge from one simulation run to another. To offer a more comprehensive perspective and mitigate the impact of this inherent randomness, I am providing the findings from five distinct simulation runs.

By sharing the results of multiple runs, we aim to paint a more holistic picture of the potential outcomes within the scope of this probabilistic model. This approach accounts for the inherent unpredictability associated with financial markets and underscores the significance of considering a range of possible scenarios. It also allows us to better assess the robustness and consistency of the insights gleaned from the simulation, acknowledging that variations may occur due to the stochastic nature of the model.

Across all five simulation runs, our investment strategy consistently outperformed the returns generated by our initial greedy solution, which involved investing solely on Mondays. However, it's crucial to recognize that there is still a possibility, albeit less likely, of underperforming in certain scenarios.

To comprehensively conclude this analysis and account for all potential outcomes, we must conduct one final simulation run. In this iteration, we will introduce an entirely random approach to day selection for investment. Each day of the week will be assigned an equal probability, ensuring a level playing field where no specific day carries a bias in terms of investment selection.

This final simulation, which embraces complete randomness in day selection, serves as the critical component to complete our analysis. It allows us to explore the full spectrum of possibilities, acknowledging that while our probabilistic strategy has shown promise, there remains an inherent degree of unpredictability within financial markets. By conducting this last simulation, we aim to gain a comprehensive understanding of how our approach fares under entirely random conditions, thereby further enriching our insights into the dynamics of day-based investment strategies.

On average, the returns achieved through investments made on any randomly selected day of the week tend to be just as favorable, if not more so, compared to the returns garnered by adhering to a simplistic probability distribution model or focusing exclusively on investing on Mondays. This observation underscores the notion that the day of the week, in isolation, may not significantly impact the overall investment performance.

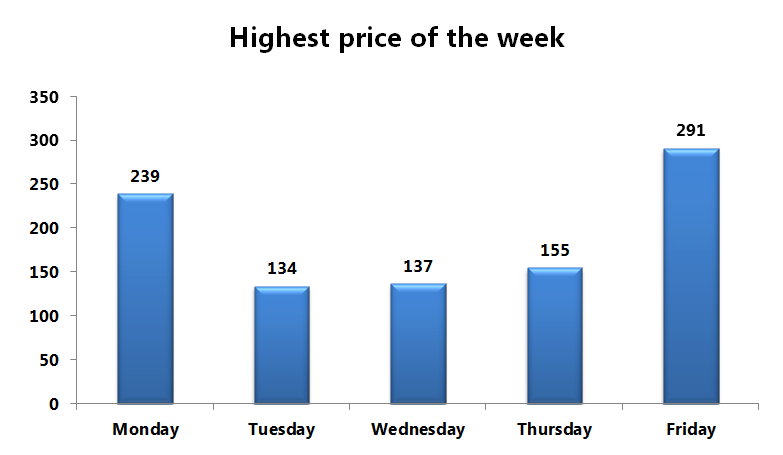

To ensure comprehensive coverage of the analysis, I also sought to present a breakdown of the days within a week when the market tends to reach its peak performance. Notably, it appears that Friday stands out as the most likely day for the market to achieve its weekly high. This observation sheds light on potential patterns in market behavior.

However, it's essential to exercise caution when interpreting this data. While a strictly "greedy" approach might involve scheduling all selling activities exclusively on Fridays, we have previously seen that such a strategy may not necessarily align with optimal results, as demonstrated in the case of buy orders.

This observation underscores the complexity and variability of financial markets, where patterns may emerge but do not always translate into consistently favorable outcomes. The market's behavior is influenced by a multitude of factors, making it important to maintain a balanced and data-driven investment strategy that considers various variables beyond the day of the week.

An alternative perspective to consider when analyzing this data involves examining the range or difference between the days with the highest and lowest values.

Considering the insights derived from the preceding analysis, it may seem that Mondays offer an advantageous opportunity for buying, while Fridays appear to be a favorable day for selling. However, as demonstrated earlier, adopting such a "greedy" approach may not necessarily result in the most optimal investment strategy. Instead, a more optimal solution involves the construction of a probability distribution.

The distribution model employed in this analysis is relatively simplistic and serves as a basic starting point. It is important to acknowledge that more sophisticated and nuanced models could be developed by incorporating additional data dimensions, such as interest rates and other relevant economic indicators. These additional factors can provide a more comprehensive understanding of market dynamics and help refine the investment strategy.

In essence, while the initial findings suggest certain days may exhibit trends, a well-informed and data-driven investment strategy considers a broader spectrum of variables, allowing for adaptability and responsiveness to the multifaceted nature of financial markets. The pursuit of optimal investment outcomes entails continuous refinement and enhancement of models to capture the intricacies of the evolving economic landscape.

Exploring the impact of macroeconomic trends on specific sectors can yield valuable insights. For instance, the Federal Reserve's regular Wednesday meetings, during which they often provide updates on benchmark interest rates—whether indicating an increase or decrease—have been of particular significance over the past five years. In this period, the focus has predominantly been on actual interest rate increases or the likelihood thereof.

These developments can exert a substantial influence on certain sectors, such as utility ETFs. In the event of a rate hike, the price of the ETF may experience a decline, subsequently leading to an increase in its yield. This dynamic underscores the interconnectedness of economic policy and market behavior, highlighting the importance of monitoring macroeconomic trends and central bank actions when making investment decisions.

Considering the broader economic context and its potential implications for specific sectors allows investors to make more informed and proactive choices, better positioning themselves to navigate the ever-evolving landscape of financial markets.

Over an extended and sustained time frame, the selection of a specific day for investment does not appear to exert a significant influence on overall returns. However, it is crucial to recognize that macroeconomic trends can indeed dictate strategic dates for acquiring particular stocks, particularly within sectors like utilities. In such instances, aligning buying decisions with specific days may be a prudent choice.

The primary objective of this article is to challenge the assertion that investing on a particular day of the week consistently leads to superior returns. Through the analysis presented, we have discerned that this claim does not hold true when considering the broader context of long-term investment horizons.

I invite you to share your perspectives and insights on this matter. Do you concur with my evaluation, or do you have alternative viewpoints to offer? Your comments and feedback are greatly valued as we collectively explore and dissect the dynamics of investment strategies and their impact on financial outcomes.

Hey DG. I read Rob's post also and will leave a similar comment. I've read with interest research like this in the past and at times tried to execute a strategy to purchase on the "best day". I found it was more than I cared to think about so I fall back to sooner is better. And, it will never be sooner than today. Tom

ReplyDeleteThanks Tom. I wanted to solidify my own thoughts i.e. the day of the week does not have any effect on the final returns. I was hoping my math would make it clear. I think it did. But, I agree with you say...Best day is today!

DeleteInteresting article. I never thought the day of the week has an impact on your investment.

ReplyDeleteHi PS. As a matter of fact it does not. That is the conclusion of my article :-)

DeleteLove the concept of this. That debate been thrown around forever. We actually ran some calculations of this exact same thing in my statistics class a while back and the outcome was inconclusive. According to the stats we had anyway, there is no significantly statistical evidence to show one day is better than the rest.

ReplyDeleteTotally agree. I don't think the day matters at all. As Tom mentioned the best day to invest is today :-)

DeleteInteresting analysis! I remember us doing some analysis of the day of the week effect on investment returns at the business school, and while there was some evidence of potential correlations...the conclusion was that it was insignificant. Studies have shown that when any form of market "inefficiencies" or correlations are found out by market participants, they all try to utilize it (some form of arbitrage) and they end up making the market even more efficient because that "inefficiency" in the market simply fades away over time.

ReplyDeleteVery true Enoch. Reinforces my idea to invest in index funds :-)

DeleteThis is very interesting, thanks for sharing- I do the DCA approach (monthly basis) but don't have a particular day that I hit buy.

ReplyDeleteYes GYM. Interestingly the day has not impact whatsoever. So, one less thing to be worried about.

DeleteThanks for sharing this blog its very informative

ReplyDeleteInteresting and very informative article. Thanks for sharing such helpful article. Before I read this article I learn something on how to invest in stocks from the website of group of traders.

ReplyDeleteThank you! I am a regular follower and I always try to read all your articles and most of the times it really helps for us. Here we also offer some great content. Check one before you left.

ReplyDeleteColgate-Palmolive (India)

Hindustan Zinc Ltd.

Maruti Suzuki India Ltd

Sagar Cements Ltd

Nice work this blog gives clear knowledge about investment. stockinvestor.in is a stock related website which provides all stock market information.

ReplyDeleteForex

buy and sell

market makers

Forex

I am a Single full time dad on disability getting no help from their moms. It a struggle every day. My boys are 15 and 9 been doing this by myself for 8 years now it’s completely drained all my savings everything . These guys are the present day ROBIN HOOD. Im back on my feet again and my kids can have a better life all thanks to the blank card i acquired from skylink technology. Now i can withdraw up too 3000 per day Contact them as well on Mail: skylinktechnes@yahoo.com or whatsspp/telegram: +1(213)785-1553 or

ReplyDeleteAppreciate the analysis. I'm getting my MBA at the moment and was planning to propose this strategy and do the related regression analysis...you saved me the time of going down this rabbit hole, so now I need to pivot and see if I can find a better strategy!

ReplyDeleteNice blog thanks for sharing. For more information about best gaming chair go to myfurnituregoals.com

ReplyDelete